114

Maybank Sustainability Report

2014

For us to continue having a clear, powerful, and distinctive position in the

marketplace, we need to constantly focus on customers by providing access

to financial services and stewardship. If we reach our target, we will be able

to support region-wide prosperity by developing products and services that

are meaningful and innovative. The topmost question on our minds is how

to better understand the needs of our diverse customers and how to fulfil

them in the most effective way.

As our business grows in volume and scope, our contribution to the region’s

growth increases. With our expanding footprint, our responsibility also

grows. We will continue to allocate resources to make sure that we serve

our customers better and be consistent in managing our environmental

impacts. Towards this end, we believe that our business will further thrive

when embedded with elements of good governance, social innovation, and

environmental integrity.

As an industry, we are also exposed to additional impacts through the

companies we finance. Our business decisions influence the economy,

our prudence translates into security. We are committed to having deep

knowledge of our clients’ businesses, including understanding the social and

environmental issues of the sectors that we bank on.

This year's Report marks a significant milestone because we have moved

the performance report for our environmental impact under Access

to Products and Services. This is because our environmental footprint

impacts both operations and our solutions in the marketplace.

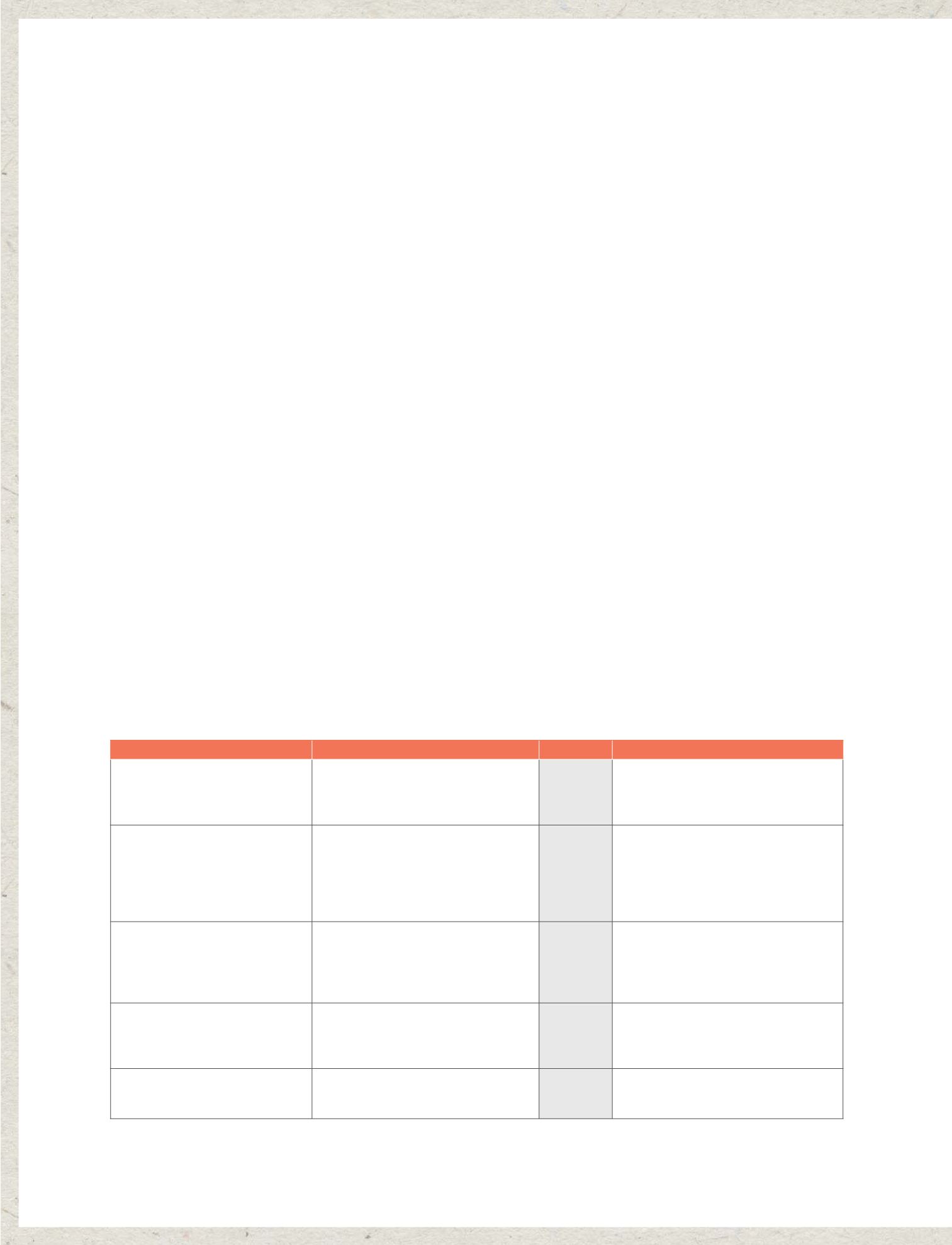

OurApproach

2014 Goals

Progress

Performance

Moving Forward

Manage direct environmental impacts

of our operations.

We are able to report on our footprint across

all six strategic buildings in Malaysia for GHG

emissions.

t

We aim to increase the coverage of reporting

of our direct environmental impacts relating

to electricity, waste, and water usage across

Malaysia.

Maintain strong customer focus and

high level of service. Expand ‘Get

Involved and Follow Through’ (GIFT)

across the region.

Through the GIFT strategy, customer

complaints are managed in a more concise

manner.

t

To focus on complaint management, product

knowledge, the voice of the customer, and

customer waiting time. Maybank Group

Service Quality Management (GSQM)

to expand its focus to include customer

experience.

Widen access to financial services by

providing new and appropriate products,

microfinance and credit to SMEs.

Extended our microfinance facilities and

launched cardless banking methods that

are accessible even for those without bank

accounts.

t

Focus on access to products and services to

ensure that all levels of society benefit. We

will extend support to SMEs through our

Group-wide framework, the Group Inclusivity

and Diversity Agenda (GIDA).

Our digital strategy is key towards

reaching new and existing customers.

Our digital footprint continued to grow in

strength.

t

To plan key initiatives as a digital lifestyle

portal, as well as to enrich existing

functionalities and capabilities we already

have via M2U internet and mobile banking.

Strengthen leadership in Islamic finance

and build a talent pool for the Islamic

finance industry.

Announced Malaysia’s first virtual Shariah

Centre of Excellence.

t

Develop talent in the area of Islamic Finance

through a targeted approach via the Shariah

Centre of Excellence.

t

On track/Completed

t

Progressing

t

Not on track/Did not complete

2014Performance

Summary

G4-DMA