126

Maybank Sustainability Report

2014

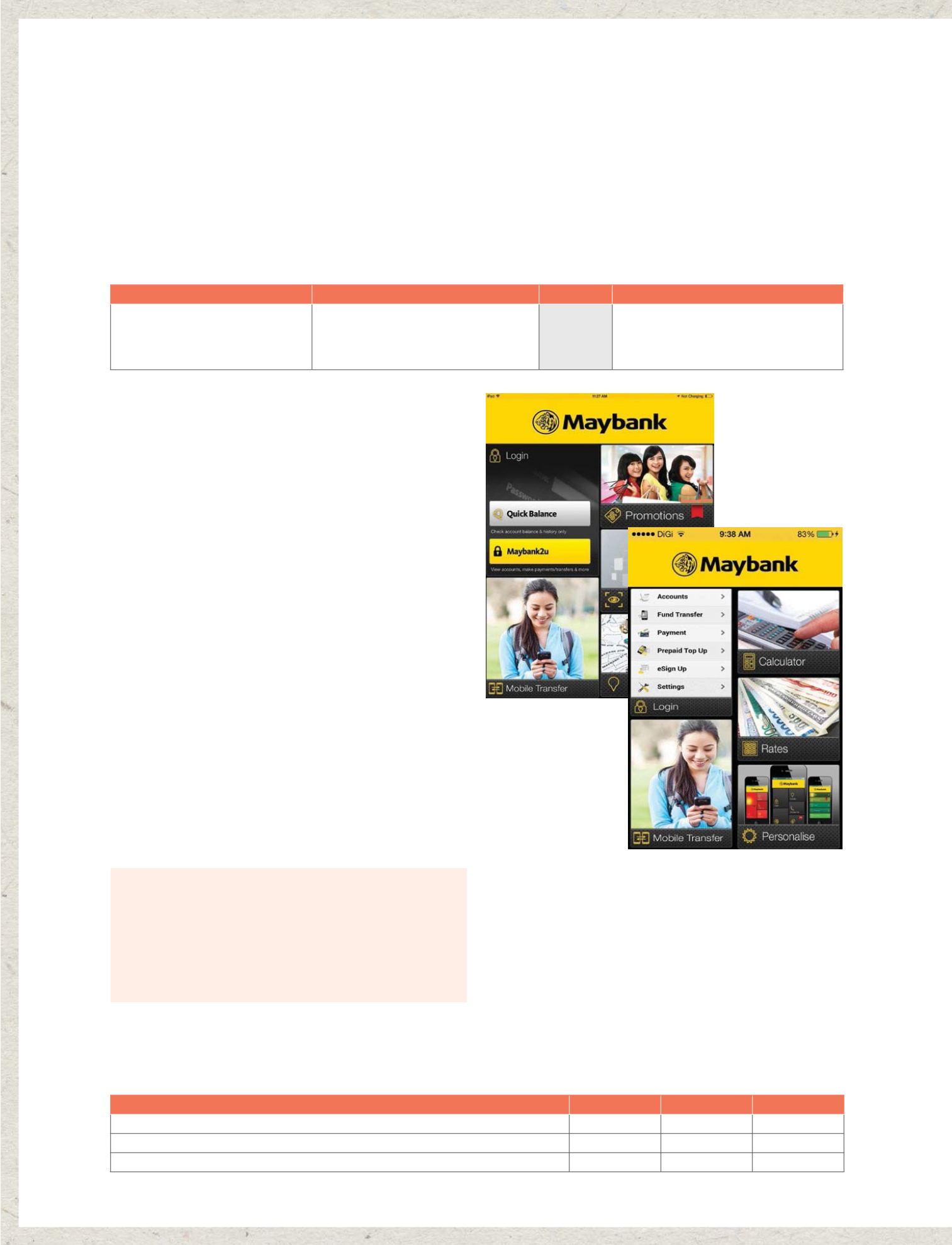

Digitisation

2014 Goals

Progress

Peformance

Moving Forward

Our digital strategy is key towards

reaching new and existing customers.

Our digital footprint continued to grow.

t

To plan key initiatives as a digital lifestyle

portal, as well as to enrich existing

functionalities and capabilities we already

have via M2U internet and mobile banking.

The Maybank Group Digital Strategy looks at tapping into the shift in

customer behaviour where the social and personal space is intertwined

essentially, moving banking closer to the customer.

To be successful in the digital space, we continue to build the following

capabilities:

þ ,PSURYHG GLJLWDO EDQNLQJ SODWIRUP LQWHUQHW PRELOH VRFLDO WKDW GHOLYHUV

the true promise of banking anytime and anywhere, and using multiple

devices for banking transaction.

þ 7LJKWO\ LQWHJUDWHG GLJLWDO DQG WUDGLWLRQDO FKDQQHOV WR HPSRZHU

customers in getting things done with speed and ease across these

channels.

þ 7KH QHZ LQWHUQHW RU EDQNLQJ SODWIRUP ZLOO FDWHU EH\RQG MXVW

transactional needs to enable our customers to manage their financial

plans, buy any Maybank Group products, and interact digitally with

Maybankers.

þ 3HUYDVLYH SURFHVVLQJ IURP GLJLWDO FKDQQHOV WR HQDEOH XV WR UHVSRQG

originate, and deliver with speed.

þ )RU VHOHFWHG VHJPHQWV FXVWRPHUV ZLOO EH DEOH WR YLHZ WUDQVDFW DQG

manage their cross-border relationship within Maybank Group via the

digital banking platform.

These digital banking strategies will take several years to deliver. We are

ahead in some areas, but there is still much that can be done as digital

banking continues to rapidly evolve. In 2015, we have embarked on

initiatives that will further expand our customers’ ability to do business

with us online through our Maybank2u and mobile banking offerings.

Group will be at the forefront in enabling these capabilities and services

across the Group.

To ensure that Group Technology continuously support Maybank’s long-

term growth through sustainable innovation and focused delieveery, its

need to be supported by three pillars:

þ %XVLQHVV SLOODU WR HQVXUH EHWWHU FROODERUDWLRQ EHWZHHQ %XVLQHVV

Technology and Group Technology by having the Heads of IT for

Group CFS, Global Banking, Etiqa and Islamic Banking reporting into

the Group Technology structure;

þ 6XSSRUW SLOODU ZKHUH 0D\EDQN 6KDUHG 6HUYLFHV 066 SURYLGHV WKH ,7

support, Risk Management, Finance and Human Capital (across the

Maybank Group); and

þ &RXQWU\ SLOODU WR VXSSRUW WKH JURZLQJ UHJLRQDO EXVLQHVV E\ KDYLQJ WKH

Heads of IT and the country’s Chief Information Officers reporting

into the GT structure.

Year

2012

2013

2014

No. of M2U registered online users (million users)

6.5

6.9

7.8

No. of M2U registered mobile users (million users)

0.9

1.3

1.5

No. of small businesses using M2U

88,752

112,755

142,007

“In striving to deliver consistent user experience for

customers, we are always looking to simplify and diversify

our services.”

Mohd Suhail Amar SureshAbdullah

Group Chief Technology Officer

*Appointed w.e.f. 1

st

Apr 2015

G4-EC7

t

On track/Completed

t

Progressing

t

Not on track/Did not complete