5

Maybank Sustainability Report

2014

SIGNIFICANT EVENTS IN 2014

15 January -

Maybank Premier Wealth was

launched in Singapore andMalaysia.

4 February

-

Maybank became the first bank

to offer trade financing in Malaysian Ringgit

(RM) across China through branches in Beijing

and Shanghai.

13 February -

John Chong was appointed as

CEO of Maybank Kim Eng Group and Maybank

Investment Bank Berhad.

23May -

Maybank launched its inaugural

TOKYO PRO-BOND Market listed transaction,

raising JPY31.1 billion (USD305 million).

18 June -

BII issued subordinated debt of IDR1.5

trillion and Mudharabah Sukuk of IDR300 billion.

12 August -

Maybank launched its life insurance

arm, Etiqa Insurance Pte. Ltd., to distribute

products through Maybank Singapore.

29 August -

Amirul Feisal Wan Zahir was appointed

as Group Head of Global Banking (GB), effective

1 October.

8 September -

Maybank launched itsMaybank2u

(M2U) app, enabling allM2Utransactions ona

smartphone.

1 October -

Maybank was granted a banking

licence to open a branch in Myanmar.

31 October -

Maybank launched

myTrade2Cash, a centralised online trade

financing facility for SMEs and the first of its

kind in ASEAN, offered in collaboration with

Dagang NeXchange Bhd.

28 November -

BII shareholders approved a

rights issue of IDR1.5 trillion at the Extraordinary

General Meeting.

28 November -

Maybank launched its inaugural

GreTai SecuritiesMarket listedUSD500million

Notes.

18 December -

Maybank (Cambodia) Plc.

launched Maybank Premier Wealth at the

official opening ceremony of Maybank’s 18

th

branch in Cambodia.

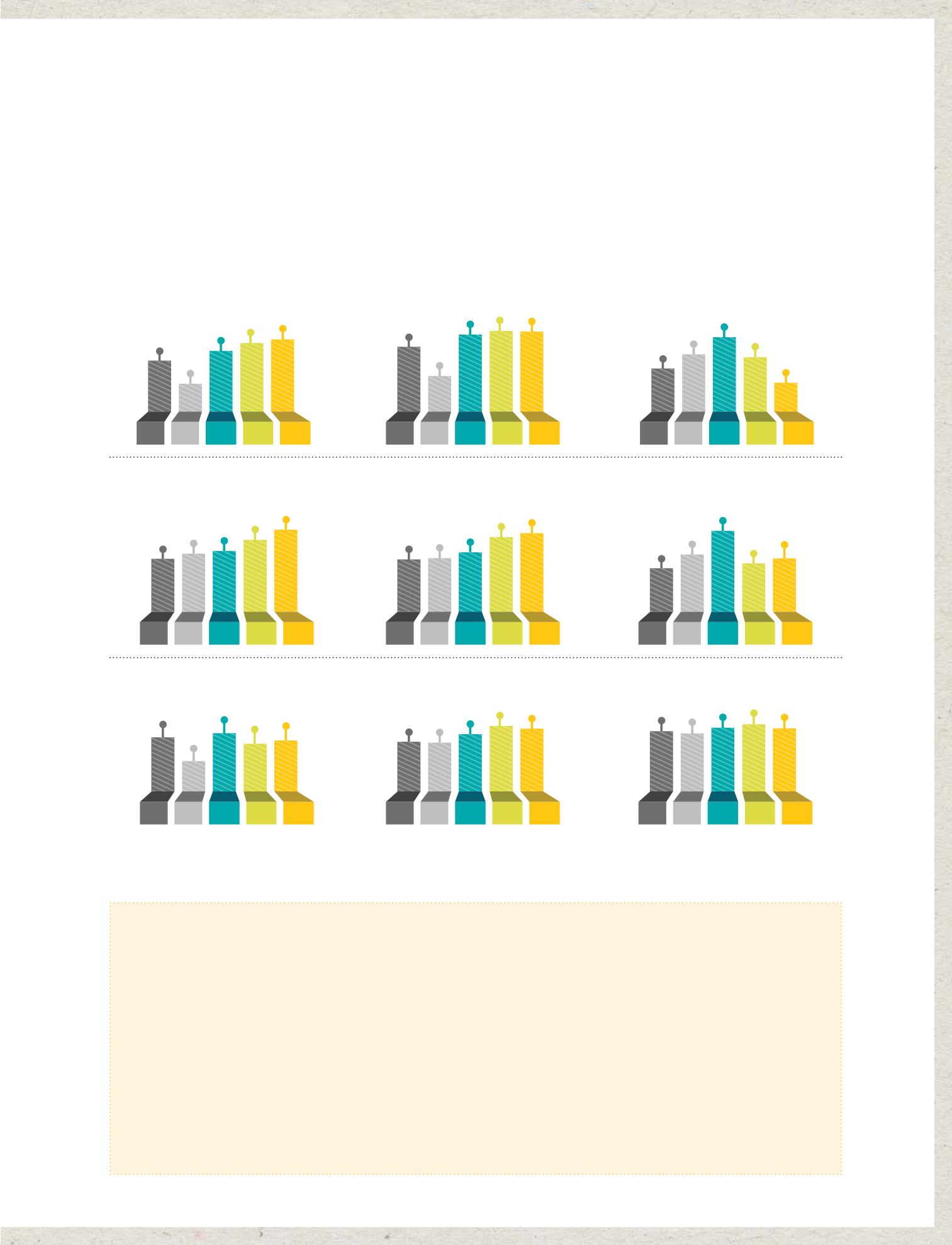

Total Assets

RM640.3

billion

Loans, Advances, and Financing

RM403.5

billion

Total Capital Ratio

16.235

%

^^

451.6 494.8

560.3

411.3

640.3

FY11 FP11* FY12 FY13

FY14

276.3

311.8

355.6

255.0

403.5

FY11 FP11* FY12 FY13

FY14

16.37

^

17.35

^

15.664

^^

15.36

^

16.235

^^

FY11 FP11* FY12 FY13

FY14

Net Profit

RM6.72

billion

Earnings Per Share

74.2

sen

Return on Equity

13.8

%

Gross Dividend Per Share

57.0

sen

Market Capitalisation

RM85.5

billion

36.0

65.0

53.5

60.0

FY11 FP11* FY12 FY13

FY14

65.5

77.6

88.1

66.9

FY11 FP11* FY12 FY13

FY14

8.58 9.20 9.94

8.94

FY11 FP11* FY12 FY13

FY14

Share Price

RM9.17

2.59

5.75

6.55 6.72

4.45

FY11 FP11* FY12 FY13

FY14

34.5

72.7 75.8

61.4

74.2

FY11 FP11* FY12 FY13

FY14

15.2

16.0

#

15.1

14.5

13.8

FY11 FP11* FY12 FY13

FY14

57.0

85.5

9.17

FINANCIAL HIGHLIGHTS

* Refers to six-month financial period ended 31 December 2011 due to the change of financial year end from 30 June to 31 December

#

Computed based on weighted reallocation of additional RM3.66 billion capital raised in October 2012

^

RWCR and assuming full reinvestment of Dividend Reinvestment Plan

^^

Total Capital Ratio (TCR) is computed in accordance with Capital Adequacy Framework (Capital Components) issued by Bank Negara Malaysia on 28 November 2012

Financial

Highlights